Hvac Insurance Companies

Contractor Workers Compensation Insurance

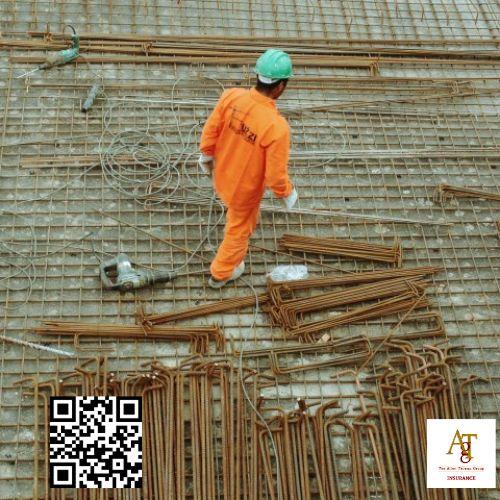

This is covered by general liability insurance, an essential part of a contractors insurance policy. It offers contractors peace of mind by extending their liability coverage and ensuring they are adequately protected in case of large claims or lawsuits. It offers contractors peace of mind by extending their liability coverage and ensuring they are adequately protected in case of large claims or lawsuits.

By protecting your bottom line, insurance gives you the security and peace of mind to focus on your work, not worry about risks. Stay protected with contractor insurance from The Allen Thomas Group Commercial. Stay protected with contractor insurance from The Allen Thomas Group Commercial.

Avoid choosing coverage based on cost alone and work with agents who truly understand your business. It depends largely on the scenario, and practices vary by industry. It depends largely on the scenario, and practices vary by industry.