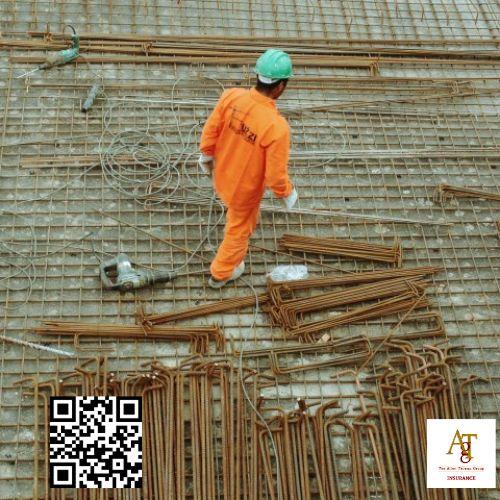

Contractors Insurance Services

Artisan Contractor Insurance

That's why The Allen Thomas Group has a specialized construction claim service operation to focus on these unique claims. One of the most influential factors affecting your contractors insurance cost is the type of work involved in your specific trade. insurance for contractors . One of the most influential factors affecting your contractors insurance cost is the type of work involved in your specific trade.

Fifty-three percent of contractors report that professional positions – project supervisors, estimators and engineers – are difficult to fill. Construction claims are complex and potentially volatile. Construction claims are complex and potentially volatile.

We offer insurance by phone, online and through independent agents. Independent contractors face similar legal obligations and liability exposures as larger firms. Independent contractors face similar legal obligations and liability exposures as larger firms.